The Case for Range-Bound Derivatives Products

The Case for Range-Bound Derivatives Products

Bracket vs. Perps: Embracing Volatility

Perpetual futures contracts, aka perps, are unarguably the most widely adopted flavor of derivatives amongst crypto traders. From BTC to PEPE, if a token has a healthy trading volume, there’s probably a perps market. But what makes perps so popular with traders? And why are perps traders notoriously unprofitable? Today we’re exploring the answers to these questions and presenting alternative types of derivatives, Range-bound Products, which are better suited for traders in various market conditions. BracketX offers a few different styles of range-bound products, including Bracket, Channel, and Passage which is launching Summer 2023.

Why Perps Have Been Successful

One of the main reasons perps have dominated the derivatives scene is the ease of use. They offer simple directional exposure, access to leverage and can be used for speculation or hedging. Traders deposit collateral, take a long or short position, and profit if the price moves in the direction they choose. Position costs typically consist of execution fees upon opening or closing a position, deposit fees for adding collateral, and funding payments. Funding payments can work either in a trader’s favor or against them. They depend on whether the trader’s chosen direction matches the overall open interest on the trading platform. Longs periodically pay shorts when there is a larger volume of longs, and vice versa.

Risks are fairly straightforward as well. Traders enter a position at a specific mark price and are assigned a liquidation price depending on the leverage they apply. Platforms typically offer anywhere from 1–125x leverage. The more leverage is applied, the smaller the difference is between a trader’s entry price and the liquidation price. This leads to the discussion of why perps traders on aggregate are losing:

Crypto assets are the most volatile class of assets across all markets. While this can make for some spectacularly fast 10x, 20x, or even 50x gains, high volatility is why perps traders are generally unprofitable. Here’s an example of an all too common perps trading scenario:

Say a perps trader is fairly confident the market will move up in the near term and takes out a leveraged long. If the market dumps below their liquidation price, their position is automatically closed out, and the collateral is liquidated. Even if price recovers immediately after, the trader still takes a 100% loss due to volatility triggering a liquidation.

Of course, on most platforms, there’s the ability to set stop losses and avoid losing all your collateral due to adverse volatility, but the root of the problem is this — perps are not volatility friendly, and crypto is a high-volatility market. This is a huge reason why GLP shined as a top-performing asset throughout the early stages of the 2022 bear market, as the pool grew upon GMX traders’ losses.

The Difference with Range-Bound Products

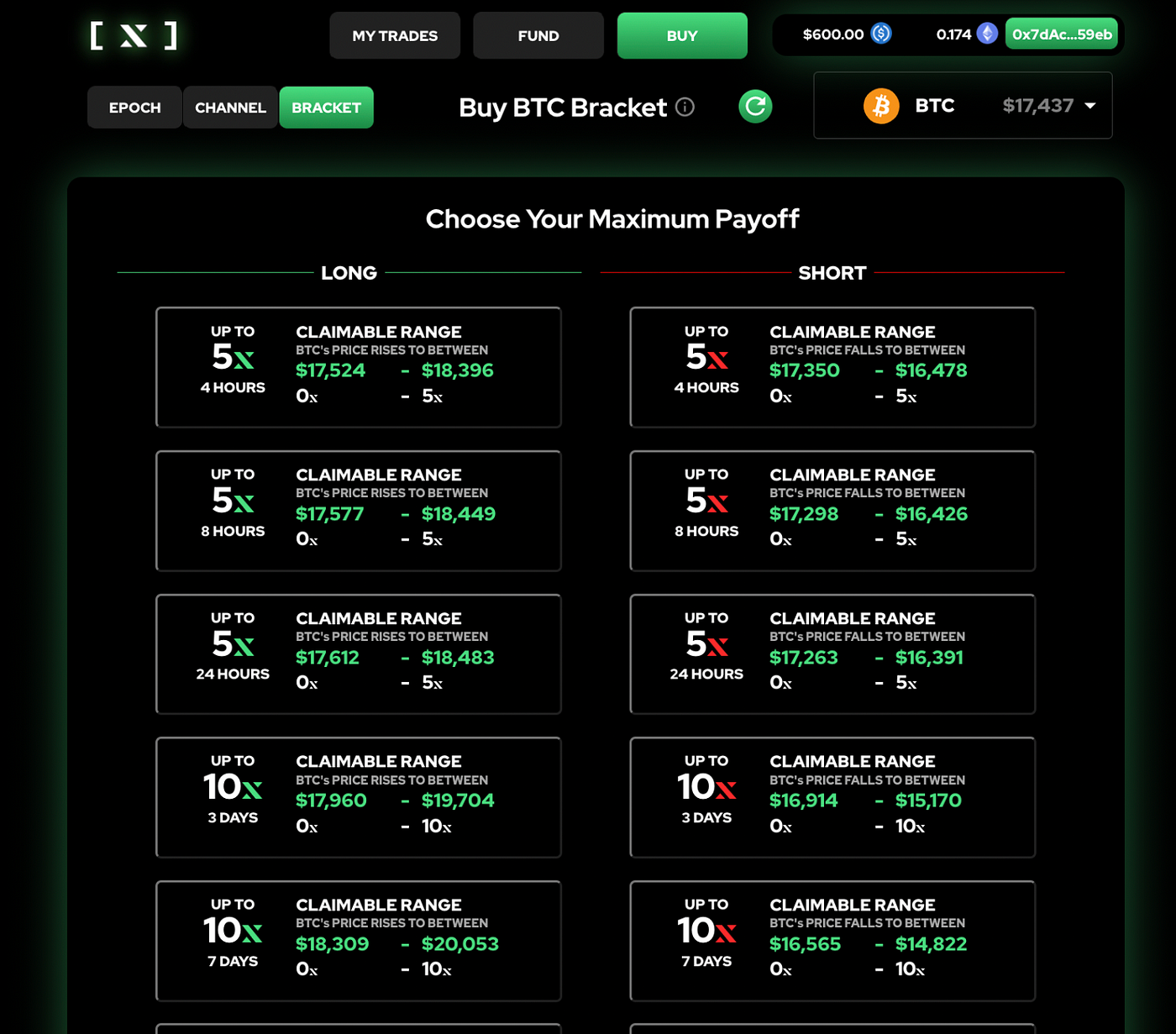

At the core of Bracket’s range-bound products are another type of derivative, options. Options positions are much more suitable for playing volatility trades than perps, as payoffs are received based on hitting a strike price within a certain time frame. Substituting payoff ranges for a concrete strike price allows Bracket to incorporate leverage into the product. For Brackets, the deeper into the range an underlying asset’s price goes, the higher multiple is applied to a Bracket trader’s payoff. With perps, more leverage means taking on more risk with a slimmer margin for liquidation. With Brackets, more leverage is unlocked by correctly predicting the market, and no additional risk is added.

The idea behind range-bound products is to combine the best of both worlds between options and perps. Users get the simplified trading experience and access to leverage that has drawn so many crypto traders to perps, without the risk of getting their position blown out by volatility.

This is why centralized exchanges like Binance are adding range-bound products to their offerings; they fill a clear gap in the crypto derivatives market. Bracket is leading the charge for decentralized range-bound products and, like many of the most popular derivatives platforms, is built on Arbitrum to keep costs low for traders.

Range-bound Products for All Market Conditions

If you’ve been around the crypto markets for a while, then you already know periods of high volatility are often followed by “crab markets,” where volume and price action are muted.

This is where another range-bound product, Channel, fits nicely into a trader’s arsenal. While Brackets allow traders to bet on breakouts, Channel positions pay out when the underlying asset’s price stays within a given range for a period of time. In crab markets, perps traders may try to do some “scalping”, which involves setting up highly leveraged longs or shorts with tight stop losses to squeeze out profits. But wouldn’t it make more sense to lean into the low volatility and bet that price won’t break out?

Channel payoffs are time based, so the longer the underlying asset’s price stays within the range, the more leverage is unlocked. If it looks like the market is entering a trough, Channel lets you take advantage. This is a type of time exposure that you can’t replicate with perps. You could achieve a similar position with a combination of traditional options, but the setup involved is more complex than most traders would like. Ease of use is the beauty of range-bound products. Simply select the Channel width and time period that fits your trading thesis, and you’re good to go.

In Summary

The data doesn’t lie; perps traders as a whole are severely in the red, and volatility is a major reason why. When trading in markets where volatility is often at the extremes, range-bound products like Brackets and Channels have distinct advantages. They offer simplicity and access to leverage without introducing the risk-reward tradeoff that has liquidated so many perps traders’ collateral. Embrace the volatility, or the crab market, with range-bound products.

.jpg)