Introduction to Passage: Range Bound DeFi Options

Introduction to Passage - Range Bound DeFi Options. Think the markets will move but don't know which direction? Try Passage to go long/short volatility!

Introduction to Passage

A new addition is coming to the BracketX roster of range-bound products, built specifically for taking advantage of those sideways trending crab markets. Passage, a reimagining of our current Epoch product, combines order book and vault models for enhanced customization and liquidity. Passage is designed for traders looking to take on short-term volatility positions without a directional bias. Whether you’re familiar with how Epoch functioned or completely new to range-bound products, this guide has everything you need to know about the newest addition to BracketX.

Passage Structure

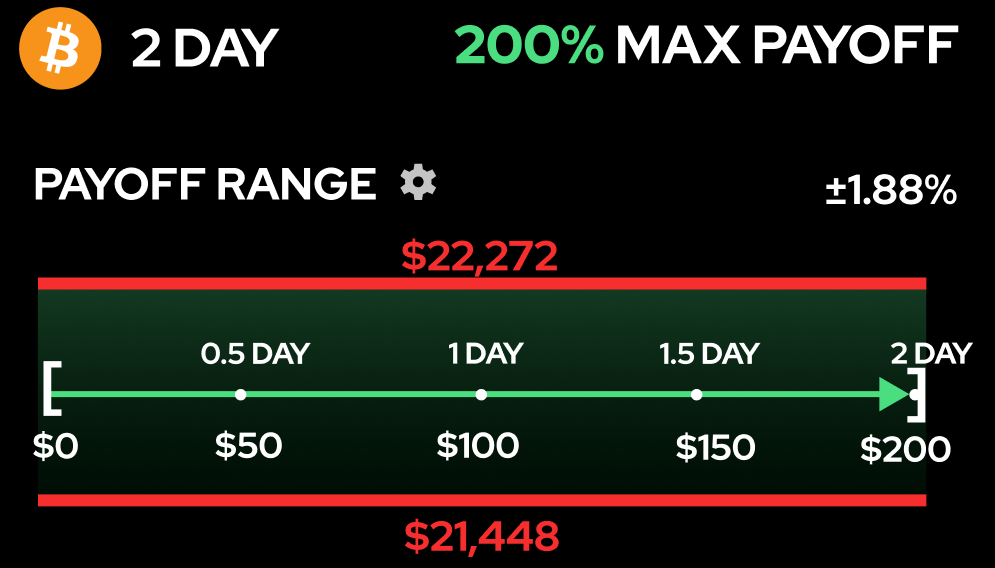

Each Passage has a price range equidistant above and below the chosen asset’s spot price. Each also has a term, denoting the time period for which the contract exists. Initially, all Passages will be 2-day contracts, but this may be changed to a customizable parameter in the future.

There are two sides to choose from within Passage, “Stay In” or “Breakout” of a range, and payouts are time-based for both. The payout for a Stay In position increases linearly over the contract term, reaching a break-even point at 24 hours and a max payout of 200% at 48 hours. Payout structure works inversely for a Breakout position, starting at 200% and declining linearly over the contract term.

As soon as a break out occurs, the Passage is closed and the payout is automatically claimed. This process is conducted through Chainlink Automation, which uses a secure and cost-efficient off-chain monitoring system to detect the breakout and initiate the claim on-chain. Payouts are made in kind with the asset used to purchase the Passage.

Order Filling

When placing a Passage order, traders will be presented with an algorithmically generated range that is more likely to be filled based on market and protocol conditions. However, if a custom range is desired it can be entered by clicking the gear icon.

Orders are good-until-canceled (GTC), meaning they will stay open unless filled or taken down by the user.

Liquidity

A vault will be established that acts as the counterparty on certain criteria meeting Passage orders. Users funding the vault will receive a percentage of fees generated from the orders it fills, distributed pro rata. This liquidity pool will help orders get filled more reliably as long as they fall within acceptable parameters, making the Passage trading experience much smoother.

Advantages & Uses Cases

Now that the basics have been laid out, let’s look at why Passage is a valuable addition to BracketX and the market in general.

Long & Short Volatility

For traders, Passage is a tool that can work in any market scenario, as positions carry zero directional bias. There are plenty of ambiguous market catalysts that pop up, for instance, FOMC meetings or upcoming regulatory decisions, and traders may have different takes on which way a certain asset will respond, but either way significant movement is expected. This is where a Breakout Passage becomes the perfect way to play both sides, with the added bonus of leverage being based on breakout timing rather than added risk.

Between volatility spikes, there are often extended lulls in crypto-asset price action, and Stay In Passages are built for such crab market conditions. It’s a short volatility trade, and stock market traders have used instruments like the CBOE’s VIX to get this type of exposure for decades. BracketX is the first to offer a product of this nature to the crypto derivatives market.

Providing Vault Liquidity

There’s yet another way to play Passages, and this involves the vault. Aside from creating deeper liquidity for Passage orders, depositing in the vault is a way to earn yield from trading fees. For testing purposes, deposit access will be invitation-only to start, but we plan to switch to permissionless deposits assuming early metrics align with expectations. Deposits will be made and paid out solely in ETH, but the liquidity can be used to fill any Passage order (i.e into BTC or ETH markets). Passage will default to rolling deposits every 30 days and depositors can withdraw at the end of the 30 day cycle if they so choose. Like other derivatives trading LPs, Passage vault depositors take the opposite side of orders being placed, so their PnL is inversely related to the PnL of those orders. Traders losing will boost vault yield and vice versa for winning trades. A full explanation of vault assumptions and expected return rates will be provided on the vaults page when it’s live.

Hedging

For perps traders, Passages can be used to hedge positions. As we explored in a previous blog, naked perps positions are vulnerable to volatility, contributing to the large net negative PnL of perps traders. Combining a perps position with a Breakout Passage is an effective hedging strategy.

Purchasing a Passage with a range that aligns with your perp’s liquidation price offers protection, as the Passage will pay out if that threshold is reached. There’s also an additional upside to hedging a perp with a Passage because of the non-directional nature. In a scenario where a perp position is profitable, there’s a good chance the Breakout Passage is also making money.

Conclusions

Passage makes it simple for traders to take on pure volatility exposure with access to leverage that doesn’t require additional risk. The ability to long or short volatility ranges is not only useful for speculation purposes but an excellent tool for hedging as well, something that perps traders should consider adding to their toolkit. Finally, the vault adds another angle for earning on BracketX, allowing depositors to earn passive income from trading fees while improving liquidity conditions for those trading with Passages.

Passage Documentation: https://bracket-labs.gitbook.io/bracket-labs/bracketx/passage

.jpg)